In March 2020, the way forward for the ski business appeared unsure. With resorts shut down throughout the nation and questions on how excessive and extended the response to the coronavirus must be, a winter of snowboarding now not appeared like a certain factor. Within the years since, snowboarding has appeared to bounce again even stronger than earlier than. With a number of years of perspective, questions can now be answered about how a lot of the bounceback was solely resulting from regular development within the ski business. How a lot of it got here from pandemic improvements carried out by resorts to maintain individuals snowboarding?

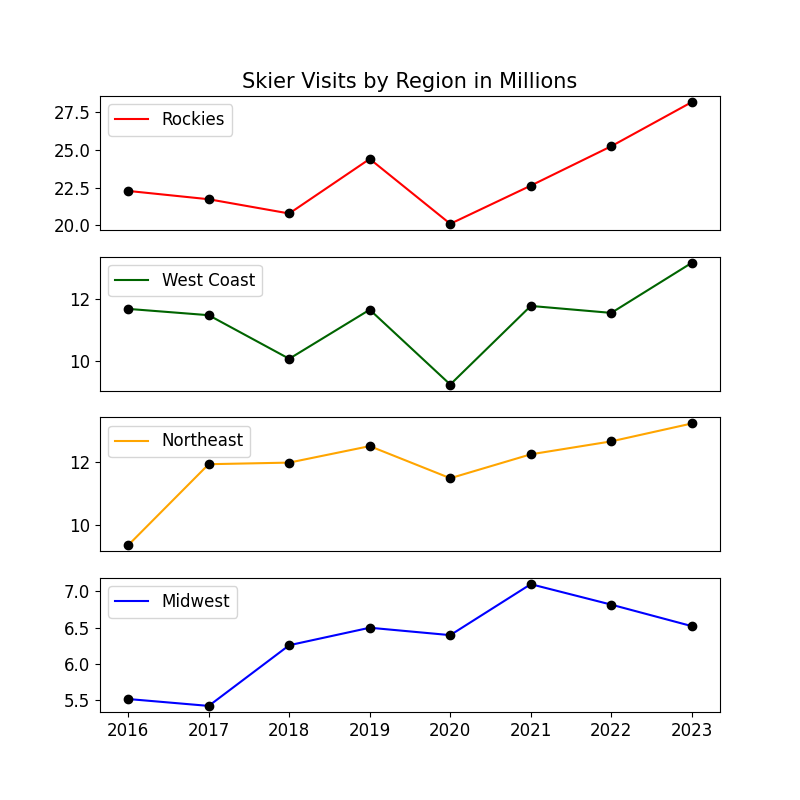

Yearly, the Nationwide Ski Space Affiliation collects knowledge on the variety of skier visits in every area in the USA. These knowledge give perception into the place individuals went snowboarding in the course of the pandemic. The graph under is damaged out by area and exhibits the whole variety of visits per yr.

Whereas all areas skilled a drop in skier visits in 2020, the magnitude of this drop varies fairly a bit. The Rockies and the West Coast noticed large dips, whereas the Northeast and Midwest noticed solely reasonable decline. Certainly, the Rockies and West Coast get lots of skier visits from ski holidays, lots of which had been minimize quick or canceled by the pandemic. However, the Northeast and Midwest are house to smaller, extra native resorts and are nearly solely visited by a loyal group of constant skiers and snowboarders. Many of those Northeastern and Midwestern riders could have needed to cancel their journeys out west that yr, however they discovered loads of time to ski nearer to house, partly possible resulting from advantages of work-from-home insurance policies.

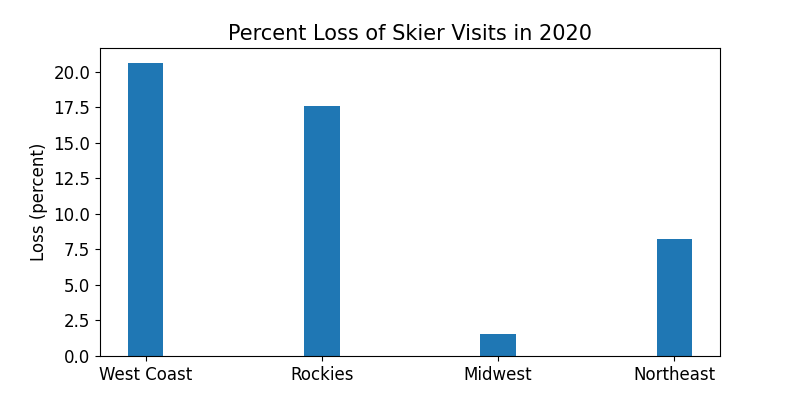

Considered a special approach, the distinction in skier go to drops by area is staggering. The bar chart under exhibits the % drop between 2019 skier visits and 2020 skier visits by area.

The Midwest had nearly zero drop in skier visits in the course of the 2020 season. In reality, the Midwest has skilled sharper declines in recent times resulting from low snow and heat circumstances. A part of the explanation for such a small decline in skier visits within the Midwest and Northeast might also be that their seasons are usually a month or two shorter than the West Coast or the Rockies. There are additionally fewer individuals snowboarding within the Midwest in comparison with different areas of the nation. Since many ski resorts didn’t shut till properly into March 2020, the Midwest and Northeast possible already tallied lots of their anticipated skier visits for the common season, which generally runs from somewhat earlier than Christmas to proper round spring break in mid-March.

Ski resorts primarily depend on skier visits to make cash. Regardless of all the costly lodges, exorbitantly priced cheeseburgers, parking charges, and pricy booze, nearly all ski resorts nonetheless derive most of their earnings from day ticket and season cross gross sales. In recent times, resorts throughout the business have been making an attempt to maneuver in direction of extra season cross holders and fewer day ticket gross sales. Season cross gross sales are extra dependable earnings than day tickets. Resorts normally have a fairly good concept of how a lot income they may have for the yr, and stretches of unhealthy snow or poor climate have much less of an affect on total income. Promoting extra season passes shifts extra of the danger of unhealthy circumstances onto the cross holder. On the identical time, resorts don’t absorb as a lot cash on huge weekend powder days that draw huge crowds.

In the course of the pandemic, the shift in direction of promoting extra season passes insulated the ski business from a tough crash. When resorts shut down early in 2020, extra season cross gross sales meant much less income misplaced to day tickets that will have been offered within the spring. Lindsay Hogan, Senior Director of Communications for Vail Resorts, informed me in an electronic mail:

“Our firm’s core technique of advance dedication via the Epic Cross is what has made this potential. By incentivizing visitors to purchase their snowboarding and driving forward of the season, we lock in income earlier than the snow falls, which has allowed us to repeatedly make investments again into our resorts, our staff, and our communities, regardless of the climate—and even amidst a worldwide pandemic. It has created stability for an business that traditionally was dominated by climate.”

Vail Resorts is a publicly traded firm, which means the Securities and Change Fee requires Vail Resorts to submit quarterly and annual reviews detailing the monetary efficiency of the corporate. These reviews give an in depth look into how Vail Resorts was impacted in the course of the pandemic and within the years that adopted. Going past details about skier visits, these reviews give a clearer image of how a lot cash the corporate was bringing in, and the way it selected to spend that income.

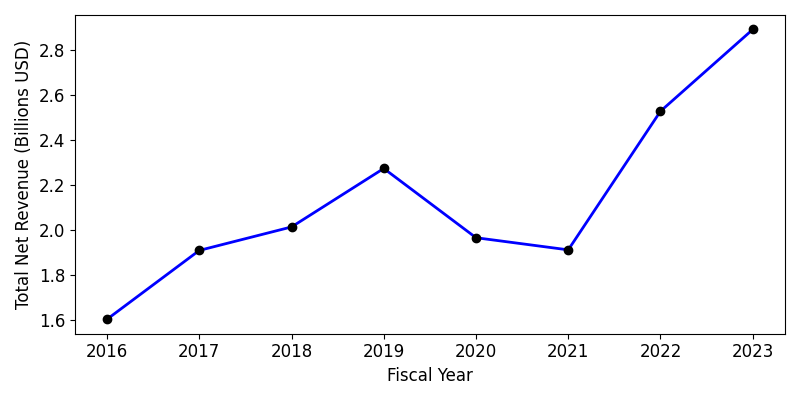

When taking a look at how Vail Resorts carried out financially, one of many easiest items of data to start out with is the whole internet income. This takes into consideration all the cash from raise tickets and season passes, meals and beverage, resort income, and rather more. Proven under is a plot of Vail Resorts’ annual income from 2016 to 2023.

In 2020 and 2021, Vail Resorts skilled a pointy decline in internet income. This downturn mirrors the information proven above for skier visits and was fully anticipated. Fewer individuals went snowboarding, which means Vail Resorts took in much less cash. Nevertheless, 2022 and 2023 noticed an explosion in income, at a quicker price than the interval between 2016 and 2019. In reality, this bounce again has been so substantial, that 2023 seems to comply with the identical prepandemic development charges, making it appear to be the pandemic by no means occurred, financially no less than.

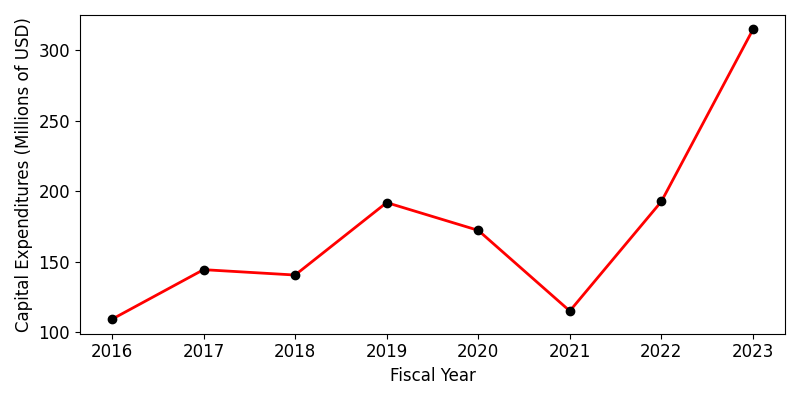

A part of this explosion in income could also be from the great quantity of funding Vail Resorts put into capital expenditures. These capital initiatives are large-scale resort upgrades that embrace chairlift development, terrain expansions, lodge renovations, and different headline-making initiatives. Under is one other plot, this time exhibiting how a lot cash Vail Resorts spent on capital initiatives between 2016 and 2023.

At first look, the story seems to be much like skier numbers and whole income, with a downturn in 2020 and 2021, then a surge in 2022 and 2023. You will need to word the dimensions of this plot. Since 2016, Vail Resorts capital expenditures have almost tripled. With 2021 capital expenditures close to 2016 ranges, Vail Resorts has almost tripled its capital expenditures in simply two years. These giant capital expenditures, no less than for Vail Resorts, sign each well being and optimism within the ski business.

Capital expenditures may help drive extra guests to ski areas as a result of they normally contain vital modifications or upgrades. For instance, among the initiatives Vail Resorts have not too long ago accomplished have included an upgraded gondola and chairlifts at Whistler-Blackcomb in British Columbia and terrain growth at Beaver Creek in Colorado. These enhancements elevated uphill capability and unfold out crowds, making the resort extra engaging.

Vail Resorts has additionally portioned an unlimited quantity of its capital expenditures in direction of Breckenridge Resort in Colorado. In 2021, a brand new high-speed chairlift was put in on Breck’s Peak 7. In 2022 and 2023, a number of fixed-grip double chairlifts had been changed with high-speed quads, considerably growing the uphill capability. Every chairlift set up can value properly over a million {dollars} and take many months to finish. All of those upgrades at Breckenridge possible concerned planning properly earlier than the pandemic began. Regardless of no capital initiatives in 2020, Vail Resorts has taken on an bold quantity of enhancements in recent times, demonstrating a optimistic outlook for the longer term.

Past the headline initiatives at world-famous resorts like Whistler-Blackcomb and Breckenridge, Vail Resorts has introduced a equally intense degree of funding to its different smaller resorts. “All of our resorts, even our smaller ski areas within the Northeast, Midwest, and Mid-Atlantic, are important to our enterprise technique and the way forward for our sport,” Hogan stated. “Resorts like Wilmot outdoors of Chicago or Mount Sunapee close to Boston or Liberty close to Washington, D.C. are the place the overwhelming majority of skiers and riders be taught the game–as they’re near among the largest inhabitants facilities within the nation. So persevering with to take a position into these resorts is important.”

Vail Resorts was not the one member of the ski business to pursue large capital initiatives instantly following the pandemic. POWDR, the Park Metropolis, Utah-based firm, pursued raise upgrades at Mt. Bachelor in Oregon, Snowbird in Utah, and Copper Mountain in Colorado, together with new lodges at Copper Mountain and Killington in Vermont. Stacey Hutchinson, POWDR’s Vice President for Communications and Authorities Affairs, shared the next assertion by way of electronic mail in regards to the lasting impacts of the pandemic on the ski business:

“Ski resorts supplied a wonderful alternative for individuals to benefit from the outside in a secure and managed surroundings in the course of the pandemic, and that continues as we speak.”

POWDR wouldn’t affirm if it has been using the same technique of pushing extra skiers in direction of season passes as a approach of insulating themselves from unexpected impacts on skier visits, much like the remainder of the ski business.

With the pandemic now a number of years within the rearview mirror, the ski business continues to develop. The worry as soon as expressed in early 2020 that the ski business could crumble now appears a bit overblown. Whether or not the continued development of the ski business is because of insurance policies and methods enacted earlier than the pandemic or in response to it’s unclear. Whereas all of us hope there are not any different pandemics looming on the horizon, the ski business is certain to face different challenges within the coming years. Decrease snow totals and shorter seasons, introduced on by the local weather disaster, can be an enormous downside for the ski business to deal with. Hopefully, the pandemic supplied a roadmap and a testing floor for tips on how to maintain the chairs spinning when the world tries to cease them.

Extra from Zach Armstrong:

- How Eldora, CO, Ski Patrollers Lastly Bought Their Union

- How the Deadly GS Bowl Avalanche at Palisades Tahoe, CA, Occurred and Why it Might Occur Once more

- Public Cash Will get Funneled into Huge Deer Valley, UT, Growth

- Ski Trade Unions Throughout America Struggle For Skilled Workers Retention and Coaching Incentives

The publish Contained in the Ski Trade’s Submit-Pandemic Growth appeared first on SnowBrains.